Senior Expert, Risk Mitigation (40000839)

Ngân hàng Thương mại Cổ phần Kỹ Thương Việt Nam (Techcombank)

- Chi tiết công việc

- Giới thiệu công ty

Vị trí công việc này hiện tại đã hết hạn nộp hồ sơ, bạn có thể tham khảo thêm một số công việc liên quan phía dưới

- Consult/ Propose/ develop/ coordinate the implementation of: (1) projects to build Collection governance/Operating model/Framework/Strategy/SystemvàPlatform/People development to maximize and maintain the operational efficiency of the Collection model ; (2) define the model; debt collection methods, principles, standards, measurement/evaluation,... in management, operation and supervision of debt collection activities to ensure efficiency

- Directly implement/advise the implementation of debt recovery strategies/methods according to regulations and processes from time to time

- Support the Director of Debt risk mitigation/Debt Risk mitigation Management và Operation in giving ideas to improve the quality of Effectiveness/Productivity of Risk mitigation strategy/operation

- Strictly comply with the Bank's Labor Regulations

- Perform work in accordance with policies, regulations, procedures, internal guidelines... , and service quality commitments (SLAs).

- Comply with the work arrangement and training of Techcombank and of the Division

1. Participate in perusing proposal/ collaborating in the deployment of bank-wide collections technology establishment/ transformation projects as well as maintaining the effectiveness of the operation of technological system/ tools regarding debt collections

- Provide analytical opinions, assessment and proposal of solution for system/ tools

- Collaborate with related units to build the set of selection criteria for system/ tools to enhance operational effectiveness

- Consult, suggest/ propose solutions in building MIS for the managemetn, forecasting and operation of debt collections

- Consult in the process of building parameters and principles to apply in debt management system (DMS) in case of emergence of new proposal for compliant assurance in collections

2. Participate in researching and proposing models, strategy, collections channel/ method, principles, regulation, accountability/ responsibility distribution, assessment/ measurement/ acknowledgement tools,... in collections management and interaction

- Consult and/ or directly involve in buidling/ establish related parts: (1) collections model (2) collections channel/ model for each customer segmentation, (3) principles to manage collections partners/ agencies; (4) distribution of accountability/ reponsibility in debt collections managament and operation, (5) plan for assessment/ measurement/ acknowledgement of debt collections effectiveness and (6) interactive/ feedback mechanism and debt management/ operation principles time to time to effectively manage collections operation as well as aligning with general policies and risk apetite framework in debt collections.

- Collaborate with related units to establish essential documents for debt collections

- Advise in building credit policy, product, program to detect implicit risks and provide solutions to control and limit risks, enhance collections effectiveness

3. Participate in collections management and operation in accordance with bank-wide models and strategies time to time:

- Directly involve/ consult in the deployement of plans to select appropriate partners/ operating units for collections demand

- Directly involve/ consult plans and methodology for operation of risk mitigation strategy/ other strategies in compliance with regulation, procedures time to time

- Consult, connect units in debt handling operation for operational units to deploy special collections strategies (debt sale, other collections strategies)

- Involve in consulting and establishing specific criteria set/ KPI and standard measurement system for operational unit

- Advise Unit Director about solutions/ orientation to manage and monitor the portfolio of problematic loans

5. Participate in monitoring collections operation:

- Involve in consulting/ account for establishing the criteria set to measure effectiveness/ deploy the effectiveness measurement process for policy/ system/ operation/ monitoring of debt collections in segmentations/ portfolios to define proposal for enhancement of management

- Involve in consulting/ account for management and deployment of inspection/ assessment process to ensure that the collections operation always comply with Risk Management framework and business direction

- Involve in consulting, suggesting in complicated cases in terms of feedback interaction or credit loop closing

6. Training: Participate in buiding/ implementing training and communication program as per request of director level to enhance debt collections effectiveness

7. Participate in consulting of building debt sale and risk transferring policies

8. Participate in consulting of building policies/ procedures/ guidance for debt collections

9. Participate in consulting of building compliance and legal policies for special business operation

10. Participate in handling complicated issues regarding debt collections operation

III. Perform other related tasks at the request of the Director, Risk Mitigation

- Experience in the field/industry related to finance/banking: at least 09 years

- Experience in risk management: at least 04 years

- Priority is given to personnel with in-depth experience in business lines (real estate/construction/...)

Expertise:

- Having in-depth knowledge of credit operations, debt management, regulations and processes related to the operation of debt collection activities in the bank as well as the system of legal documents related to problem debt.

- Having in depth knowledge in advanced maket about work areas with position ex head or lead of areas transformation

- Understanding of Data analytics portfolio risk management indicators

- Having knowledge of macroeconomic situation, building and proposing test scenarios Stress-test / Scenario Analysis Qualifications:

- University graduate or above majoring in economics/finance/banking,

- Priority is given to personnel with CFA, FRM

- Foreign language (English): minimum TOEIC 650-700 / or have worked / studied abroad / organization in Vietnam using the required language for at least 1 year or other equivalent certificates

Thông tin chung

- Ngày hết hạn: 06/07/2024

- Thu nhập: Thỏa thuận

Giới thiệu về Ngân hàng Thương mại Cổ phần Kỹ thương Việt Nam

Cùng với Vietcombank, Viettinbank thì Techcombank là ngân hàng thu hút được số lượng khách hàng sử dụng sản phẩm lớn bởi các chính sách cũng như dịch vụ chăm sóc, tư vấn và hỗ trợ người dùng tốt. Nơi đây cung cấp các dịch vụ, sản phẩm tài chính tiền tệ với sự phát triển ổn định, bền vững, quy mô rộng rãi và tạo được sự tin tưởng cho khách hàng từ lâu.

Làm việc tại Ngân hàng Techcombank lương cao không?

Mức lương làm việc tại Ngân hàng Techcombank được tính theo kinh nghiệm, năng lực qua việc áp chỉ tiêu, doanh số. Vì vậy, nếu bạn có sự nỗ lực, cố gắng thì mức lương cũng tương đối ổn định. Ngoài mức lương cơ bản, nhân viên ngân hàng còn được hưởng các chế độ bảo hiểm, thưởng, phúc lợi khác theo quy định.Ứng tuyển vào Ngân hàng Techcombank cần bằng cấp không?

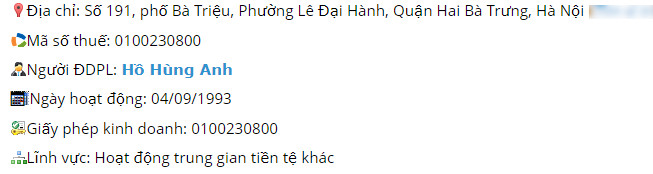

Nhiều vị trí tuyển dụng tại Ngân hàng Techcombank không đòi hỏi ứng viên có kinh nghiệm nên mở rộng cơ hội cho nhiều đối tượng. Tuy nhiên, hầu hết các vị trí đều yêu cầu ứng viên có bằng tốt nghiệp đại học trở lên các chuyên ngành tài chính ngân hàng, kinh tế hoặc chuyên ngành liên quan.Thông tin đăng ký kinh doanh Ngân hàng TMCP Kỹ thương Việt Nam (Techcombank)

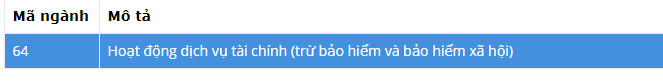

Ngành nghề hoạt động Ngân hàng Techcombank

Sản phẩm

- Thẻ Techcombank.

- Trái phiếu iBond.

- Quỹ đầu tư iFund.

Dịch vụ

- Chuyển tiền liên ngân hàng, nộp phí bảo hiểm.

- Dịch vụ tài khoản.

- Ngân hàng điện tử.

- Tư vấn tiết kiệm.

- Vay vốn.

Thông tin liên hệ

Một số vị trí Ngân hàng Techcombank tuyển dụng

Môi trường làm việc tại Techcombank

- Môi trường làm việc quốc tế

- Có nhiều seniors và experts xịn và sẵn lòng hỗ trợ, học hỏi được nhiều về chuyên môn.

- Nhịp độ làm việc nhanh, động lực làm việc từ lãnh đạo đến nhân viên đều cao

- Chính sách OT rõ ràng, hợp lý

Phúc lợi làm việc tại Techcombank

- Thu nhập: Lương cứng + thưởng KPI

- Cung cấp trang thiết bị đầy đủ để phục vụ công việc.

- Lộ trình đào tạo & phát triển công việc rõ ràng, cơ hội thăng tiến cao

- Cơ hội mở rộng phân khúc khách hàng chiến lược trong thị trường

- Làm việc trong môi trường năng động, chuyên nghiệp có nhiều cơ hội thăng tiến.

- Được hưởng các chính sách phúc lợi theo quy định của công ty.

- Được đào tạo, nâng cao nghiệp vụ thường xuyên.

Việc làm tương tự

Giải thưởng

của chúng tôi

Top 3

Nền tảng số tiêu biểu của Bộ

TT&TT 2022.

Top 15

Startup Việt xuất sắc 2019 do VNExpress tổ chức.

Top 10

Doanh nghiệp khởi nghiệp sáng tạo Việt Nam - Hội đồng tư vấn kinh doanh ASEAN bình chọn.

Giải Đồng

Sản phẩm công nghệ số Make In Viet Nam 2023.