Chuyên gia Phân tích Rủi ro ngành

Ngân hàng Thương mại Cổ phần Kỹ Thương Việt Nam (Techcombank)

- Chi tiết công việc

- Giới thiệu công ty

Vị trí công việc này hiện tại đã hết hạn nộp hồ sơ, bạn có thể tham khảo thêm một số công việc liên quan phía dưới

- In-depth consulting, implementation and control work within the scope of expertise Collateral Risk analysis in order to build and develop the management and supervision of collateral, contributing to the effective implementation of risk management tasks. At the same time, it provides solutions for business development in parallel with effective risk management for all types of collateral.

- Consult, coordinat, implement and monitor the Department's plans and activities according to the development orientation of the center, the Division, and the bank;

- Monitor and organize implementing the budget according to the annual operating plan, manage the unit's operating budget according to the approved limit;

- Ensure that the activities of the Department fully comply with the policies and regulations of the law and the bank;

- Coordinate with other departments of the Center to build and implement cross-functions of the Center and the Division.

- Consult and organize implementing the implementation of development/application of innovations, innovations and initiatives to upgrade the quality of work to meet the transformation of the organization.

- Take overall responsibility for the professional work and quality of the assigned work related to the Department with the Director

2. Responsibility for human resource management and development

- Consult to organize and arrange work and personnel in accordance with the tasks and work nature of the department;

- organize implementing a roadmap for training and developing capacity and skills for department members according to the needs and work of the department;

- Responsible for building and developing talents in line with development orientations for the department and unit.

- Consult Building and implementing departmental culture according to the nature of departments, units and financial culture of the bank;

- Coordinate with other departments of the Center to build training activities, personnel rotation and activities to connect and develop staff capacity at the unit;

Responsible for assigning all/part of the following tasks to employees of the Department - depending on the tasks from time to time:

3.1 Organize implementing and consulting about framework, criteria for understanding assets, the transformation cycle of assets and collateral

- Design, organize and build a framework of criteria for understanding assets, the transformation cycle of assets and collateral;

- Participating in consulting and building a dictionary of industry-impacting factors and identifying groups of fundamental/main factors affecting developments and fluctuations, and industry risks through understanding assets/collateral.

3.2 Consult orientation and organize risk analysis activities by industry/economic sector to assess risks of collateral

- Consult and organize the development of a reporting system to analyze industry and industry risks, contributing to the presentation of exploitation opportunities and industry risks;

- Consult and organize the development of criteria and mechanism for identification/warning/forecast, assessment of industry fluctuations, price movements affecting the receipt, management, and portfolio of collateral at TCB.

- Participate in surveys and market research conducted by the Center, etc. / Carry out field surveys in the area of the industry to point out the unique characteristics and characteristics of the industry on the basis of the survey. close to reality

- Control and/or coordinate in promulgating the price list frame of the main types of assets received as collateral such as goods, cars, real estate,... serving the valuation of collateral.

- Actively build and establish industry information base, value base of assets and collateral from enterprises/business establishments in the industry/ministries/agencies/affiliated companies/outsourced companies/companies services to collect, store and analyze information on asset/collateral pricing.

3.3 Orient and organize the risk analysis of collateral assets based on data and analysis models/techniques.

- Consulting, implementing and updating the system of collateral risk analysis database system, which can include macro and micro market information, price data, policy information, supply market information, demand, industry import and export activities, information on the list of collateral at TCB,...

- Research and apply collateral management data and indicators to develop a policy to receive collateral through qualitative criteria combined with quantitative, towards quantifying the policy of receiving collateral through appropriate criteria.

- Researching/applying/organizing the application of technical measures and tools to the construction of models of FMV/FSV/LVA/haircut valuation or risk analysis of collateral assets through through industry developments, warning identification, and risk management of collateral assets/industry.

- Research and apply/organize the application of technology in risk analysis of collateral

- Coordinating in updating information related to the industry/price movements, analyzing and reviewing collaterals according to industry warning information to warn collateral affected by industry fluctuations, asset prices.

3.5 Coordinate with the collateral policy department in developing and upgrading the collateral policy.

- Coordinate in updating the criteria/risks of collateral according to understanding of collateral to develop policies on receiving and managing collateral.

3.4 Record problems, difficulties and inadequacies in the working process, proposing/suggesting to improve the regulatory process related to the product development/approval process

- Identify risks of the unit during operation, coordinate with business units to come up with methods of measuring and minimizing risks;

- Contribute ideas on products by Industry;

4. Other quests

- Record problems, difficulties, unreasonableness in the working process, propose/suggest to improve regulatory processes related to data, systems, tools, analysis and related work

- Participating in external organizations' macro-policy/industry forums

- Identify risks of the unit during operation, coordinate with business units to come up with methods of measuring and minimizing risks;

- Other tasks assigned by the Center Director

- Expertise: at least 10 years of experience in the field of finance, banking, macro analysis, industry

- Management: 03 years of management experience

Expertise:

- Deep understanding of one/ more industries and/or business activities of enterprises in the industry, and/or banking credit operations

- Understanding customers' insight expressed through understanding of Legal/status quo of changes in the state of property transformation to design solutions for customers

- Skills to identify và build risk solutions và control risks well for each industry

- Understanding the TCB system: Understanding the organizational structure, organizational culture, goals/orientation of the bank

Degree/Profession:

- Minimum University graduate

- English: minimum TOEIC 550 (Band 6)/650 (Band 7) or equivalent

Thông tin chung

- Ngày hết hạn: 27/10/2021

- Thu nhập: Thỏa thuận

Giới thiệu về Ngân hàng Thương mại Cổ phần Kỹ thương Việt Nam

Cùng với Vietcombank, Viettinbank thì Techcombank là ngân hàng thu hút được số lượng khách hàng sử dụng sản phẩm lớn bởi các chính sách cũng như dịch vụ chăm sóc, tư vấn và hỗ trợ người dùng tốt. Nơi đây cung cấp các dịch vụ, sản phẩm tài chính tiền tệ với sự phát triển ổn định, bền vững, quy mô rộng rãi và tạo được sự tin tưởng cho khách hàng từ lâu.

Làm việc tại Ngân hàng Techcombank lương cao không?

Mức lương làm việc tại Ngân hàng Techcombank được tính theo kinh nghiệm, năng lực qua việc áp chỉ tiêu, doanh số. Vì vậy, nếu bạn có sự nỗ lực, cố gắng thì mức lương cũng tương đối ổn định. Ngoài mức lương cơ bản, nhân viên ngân hàng còn được hưởng các chế độ bảo hiểm, thưởng, phúc lợi khác theo quy định.Ứng tuyển vào Ngân hàng Techcombank cần bằng cấp không?

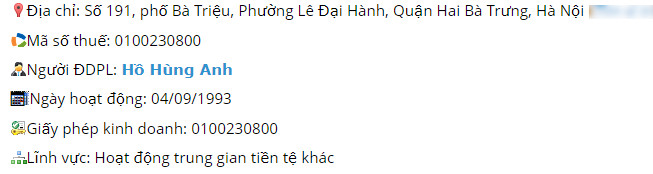

Nhiều vị trí tuyển dụng tại Ngân hàng Techcombank không đòi hỏi ứng viên có kinh nghiệm nên mở rộng cơ hội cho nhiều đối tượng. Tuy nhiên, hầu hết các vị trí đều yêu cầu ứng viên có bằng tốt nghiệp đại học trở lên các chuyên ngành tài chính ngân hàng, kinh tế hoặc chuyên ngành liên quan.Thông tin đăng ký kinh doanh Ngân hàng TMCP Kỹ thương Việt Nam (Techcombank)

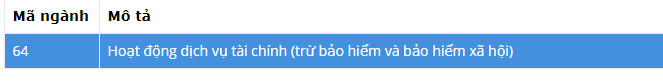

Ngành nghề hoạt động Ngân hàng Techcombank

Sản phẩm

- Thẻ Techcombank.

- Trái phiếu iBond.

- Quỹ đầu tư iFund.

Dịch vụ

- Chuyển tiền liên ngân hàng, nộp phí bảo hiểm.

- Dịch vụ tài khoản.

- Ngân hàng điện tử.

- Tư vấn tiết kiệm.

- Vay vốn.

Thông tin liên hệ

Một số vị trí Ngân hàng Techcombank tuyển dụng

Môi trường làm việc tại Techcombank

- Môi trường làm việc quốc tế

- Có nhiều seniors và experts xịn và sẵn lòng hỗ trợ, học hỏi được nhiều về chuyên môn.

- Nhịp độ làm việc nhanh, động lực làm việc từ lãnh đạo đến nhân viên đều cao

- Chính sách OT rõ ràng, hợp lý

Phúc lợi làm việc tại Techcombank

- Thu nhập: Lương cứng + thưởng KPI

- Cung cấp trang thiết bị đầy đủ để phục vụ công việc.

- Lộ trình đào tạo & phát triển công việc rõ ràng, cơ hội thăng tiến cao

- Cơ hội mở rộng phân khúc khách hàng chiến lược trong thị trường

- Làm việc trong môi trường năng động, chuyên nghiệp có nhiều cơ hội thăng tiến.

- Được hưởng các chính sách phúc lợi theo quy định của công ty.

- Được đào tạo, nâng cao nghiệp vụ thường xuyên.

Việc làm tương tự

Giải thưởng

của chúng tôi

Top 3

Nền tảng số tiêu biểu của Bộ

TT&TT 2022.

Top 15

Startup Việt xuất sắc 2019 do VNExpress tổ chức.

Top 10

Doanh nghiệp khởi nghiệp sáng tạo Việt Nam - Hội đồng tư vấn kinh doanh ASEAN bình chọn.

Giải Đồng

Sản phẩm công nghệ số Make In Viet Nam 2023.